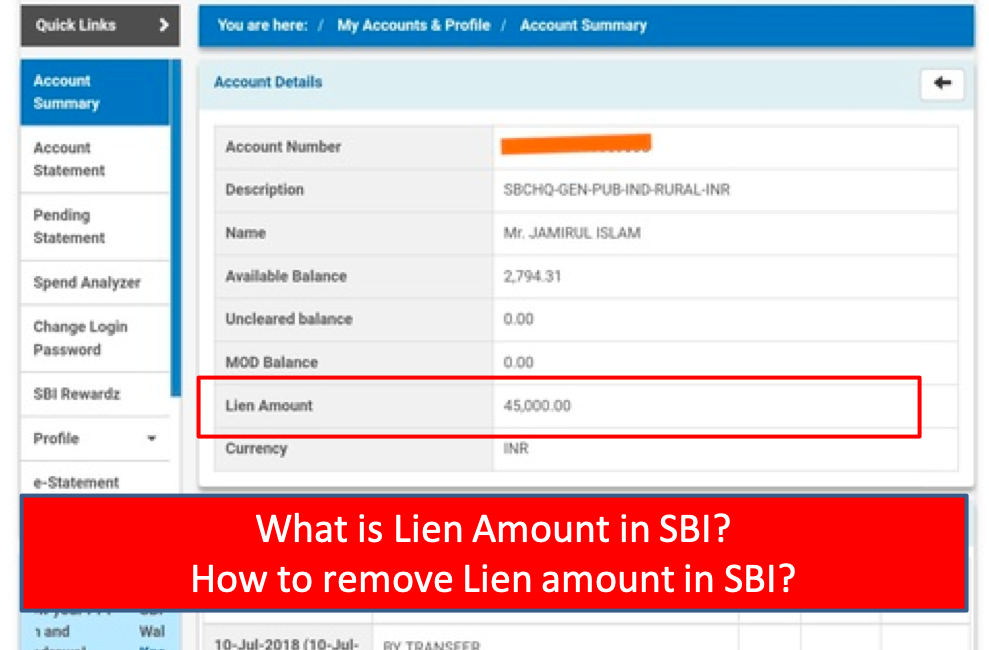

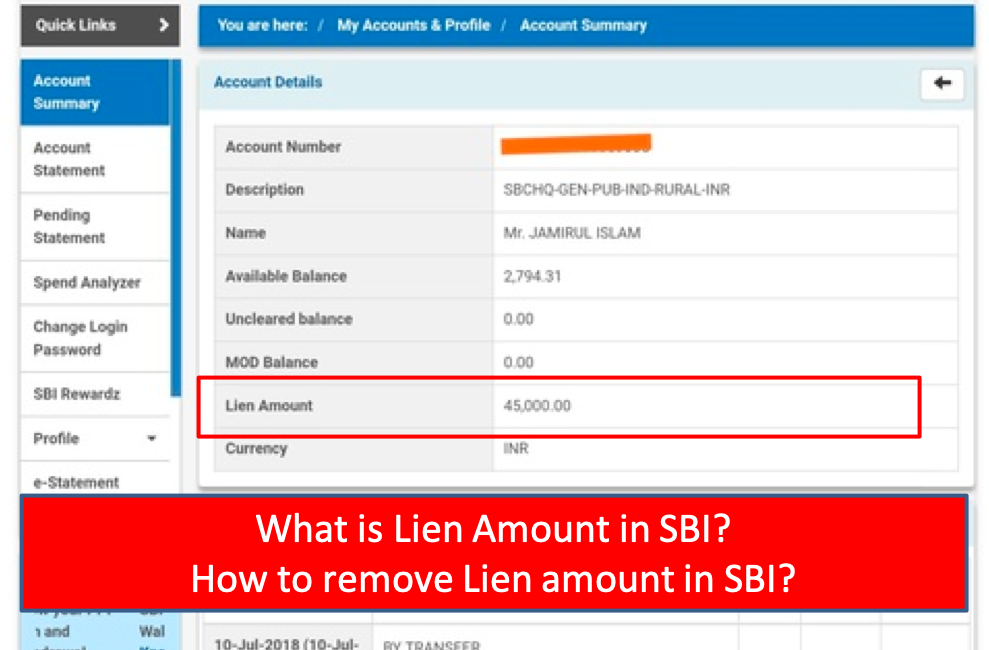

Are you worried and confused about Lien Amount in SBIWell you are not alone. In Most Cases, this should not be reason to worry. In this post we cover about following:

- What is Lien Amount?

- Reasons for Having Lien Amount in SBI?

- How can you remove lien in SBI Online & Offline?

What is Lien Amount in SBI?

Lien Amount in SBI or Any Other Bank is Blocking Specified Amount in your bank account which you cannot withdraw or use without the approved the approval of the bank or concertied aukhority. The lien may be imposed by the bank itself or may be through an authority such as court or tribunals.

The right of lien can be charged in the following ways:

• Right to Particular Lien

• Right to a General Lien

• Right to lien

However, liens in most cases are not a reason to worry. In the next section we discus what are various reasons for liens in SBI.

How to Generate Regular Monthly Income?

There can be several situations when we Look for regular incomeThis is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilies. We tell you 13 Investments which can generate regular income For you along with their pros and cons.

Reasons for Lien Amount in SBI

Your bank can put lean on your bank account due to multiple reasons. We start with the most common first.

If you Applied for iPo through your SBI Bank Account: Sebi had changed the way you can Apply for iPo a few years agoYou can apply to iPos only through your banks account using asba or application supported by blocked account. In this case the money does not leave your account until you get confirmed allotment. The money in your account is put on lien (or blocked) from the time you apply for the IPO to the time actual allotment is done. In case you get the allotment, the required money is passed on the company. In case you do not get allotment, the lien is removed automatically. The benefits of this process is there is no waiting for the money in case you did not get allotment and the money in the account still earns interest.

Use of virtual cards: SBI and many other banks have the facility to create Virtual debit cardsThese virtual cards provide an extra layer of security for online transactions. These virtual cards are very similar to physical cards – with the only different difference being Whenever you create a virtual card of certain amount, that amount is put on lien by sbi. The Amount is only debited if you actually make a transaction through your virtual card. In case you do not use the card until its expiry (which is generally 48 hours), the lien is removed from the account automatically. In case you created the virtual card or do not need it anymore, you can simply “cancel virtual card” and the lien would be released immediatily.

Fail to pay bank service charges: Bank may put a lien in case you failed to pay the charges for bank’s services. This may include charges for non-maintenance of minimum balance or hundreds of other charges that the banks have.

Do you know about Hidden Charges in Banks?

Do you know you pay a more thosand rupees every year to hidden charges of banks. This count range from more knowledge fines for not mainTaining minimum balance Amount to Lesser KNOW Posdec Charge of ICICI BankThere could be charges for atm usage, branch visits, cheque books and so on. Do read our article on Hidden Charges in Banks and What you can do about it?

Credit cards backed by fixed deposits: In case you have poor credit history, You can get credit card against Fixed DepositThis is a win-wind for bot the customer and the bank. When the bank issues this credit card, it marks lien on your fixed deposit up to the credit limit of the card.

Non-payment of credit card dues: The banks can mark lien on your bank account if you have not paid your credit card dues from the same bank.

Missed Emis on Loans: In case you have loan and bank account in the same bank, the bank may be in their legal rights to mark lien on your bank account if you have lost your EMI payments.

Lien due to court or tribunal orders: There could be lien on your account due to court orders.

Lien by tax department: The tax department can put a lien on your bank account if it has reason to believe that you have tax due. The department has to follow certain legal process to get the lien.

Lien due to suspicious activities or any issue due to issue of check or draft

Technical error: You can get a lien on your Account due to some technical error eater by the underlying software or due to manual error don by person handling it. In this case you need to speak to the customer care or the branch manager to get the lien removed.

How to Remove Lien Amount in SBI Online & Offline?

IT’s Important to understand the reason for Lien Amount in SBI As it would help us to plan the next step on how to remove lien Amount in SBI?

If your Account is on lien due to asba and you want the lien to be removed immMIDIELY, you have to send a withdrawal request with the issue to the registrar of the ipo. If you can wait, the lien would be removed if you do not get allotment of the IPO. With the effect of this, they will cancel your bid and instruct the scsb (Self-CERTIFIES SYNDICATE Bank) to Unblock your money.

If the lien is due to virtual card, You can cancel the card and the lien is removed immMIDIELYThe card expires in 48 hours and the lien is removed automatically.

For lien on your fixed deposit for your credit card, You may eather negotiate the terms with the bank or cancel the card.

For all other situations, where the lien is due to non-taxes, fees, outstanding loans, etc. to pay hes them back with penalty and removed the lien.

After completing the required accumplishment bank will remove the lien from your bank account.

If in doublet, you can contact your bank and the bank will provide the reason due to which they put a lien on your bank account and give you the way to resolve it if it is applicable.

Lien Amount in SBI Faqs

Do I Get Bank Interest on the Lien Amount in SBI?

Yes, Bank Provides Interest on the whole Amount involved the Lien Amount. You can withdraw the interest but not the lien Amount.

How to withdraw the Lien Amount in SBI?

You will be removed to withdraw the Amount marked as the lien Amount if you resolve the issue related to it. You can contact the bank for the verification of the reason and know the procedure to resolve the issue.

Is the Lien on My Bank Account is Considered as Bad?

Lien can be voluntary and non-Voluntary as well. If it is voluntary to your bank account then there is no problem.

But, if the bank puts lien from themselves it represents a negative image of the account holder and also affects his credit score.

What is the general example of lien?

Consider you have purchased a car by taking a loan. You are not able to pay your emi even after notice from the bank. Bank can put a lien on your car as well as the balance of your bank account for payment of Emi.

How long does a sbi lien last?

The period of lien in bank account would depend on the reason of the lien. It can be as short as 48 hours if the lien was against creation of virtual cards. In case of iPo through Asba, it would be for 10 days – Until the allotment is finalized. For court orders and non -Payment of dues the lien lasts until the underlying problem is resolved.