The 6 -member Monetary Policy Committee of the Reserve Bank of India (RBI) decided to reduce the repo rate by 25 to 6 per cent for the second consecutive time. Along with this, it has also been decided to change the attitude of monetary policy, which indicates further deduction in further rates. Inflation is expected to be below the target of 4 per cent in 2025, which helped the central bank to focus on support.

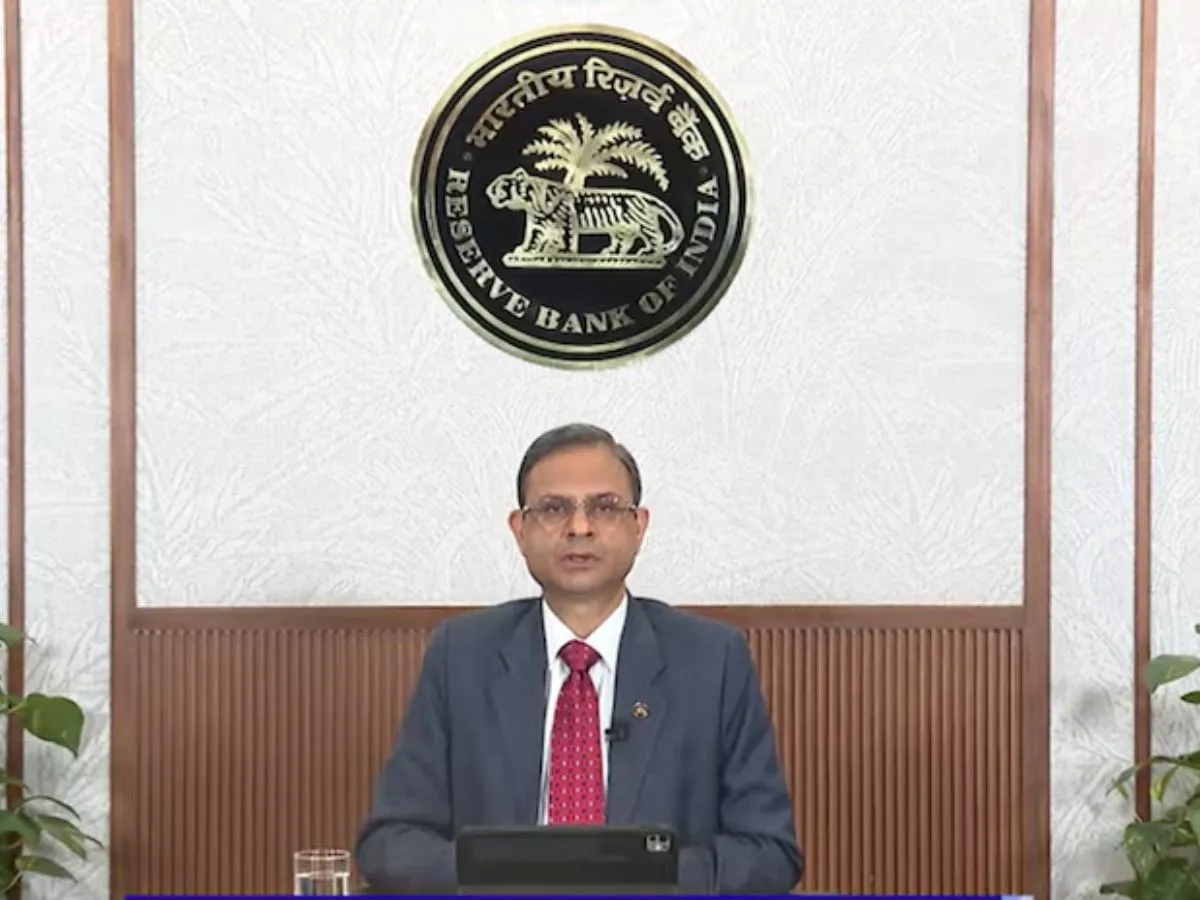

RBI Governor Sanjay Malhotra said that the fee war is increasing global uncertainty but its impact on India will be very less. He said, ‘The scenario of inflation has improved significantly. According to estimates, trust has increased over the target of 4 per cent of headline inflation in the next 12 months.

Malhotra said, ‘Even after disappointing performance in the first half of 2024-25, the growth rate is on the path of improvement. It is the demand of the hour to support the increase in challenging global economic conditions. The central bank has reduced the growth estimate to 6.5 per cent for the current financial year. In February, the growth rate of 6.7 percent was estimated. Inflation estimate has also been reduced from 4.2 per cent to 4 per cent.

HDFC Bank Principal Economist Sakshi Gupta said, “If the global tension continues to grow, we see further cuts in these estimates. We hope that the growth rate of GDP in FY 2026 would be 6.3 per cent, provided that bilateral talks were successful and there is some cut in the US fee. Gupta said, “The cash situation in the banking system is improving and it is expected to exceed its average in the current quarter. In such a situation, the impact of repo rate cuts is likely to appear in both debt and deposits.

Nomura said in a report, ‘We have been believing for a long time that the cycle of rate cut is not shallow. It has been reduced from 5.5 per cent to 5 per cent.

Malhotra said that the change in the attitude of monetary policy should not be directly associated with the state of liquidity. However, he said that liquidity management is important and is committed to providing adequate cash in the RBI mechanism. He said, ‘To’ liberal ‘with’ neutral ‘to’ neutral ‘means that if there is no setback, the monetary policy committee will consider only two options- the status quo or rate cut.’

After cutting the repo, Indian Bank announced the reduction of benchmark borrowing rate from 9.05 per cent to 8.70 per cent from April 11. It is expected that other banks will do the same.

First Published – April 9, 2025 | 10:35 pm IST

Related post

(Tagstotranslate) RBI REPO RATE CUT (T) RBI Monetary Policy (T) Inflation Forecast (T) Sanjay Malhotra RBI (T) GDP Growth Forecast (T) Dovish Policy Stance (T) Indion Bank lending Rate (T) Liquidity Management (T) HDFC Bank Sakshi Gupta (T) Nomura REPO RATE FORECAST (T) (T) RBI Repo Rate Cut (T) RBI Monetary Policy (T) Inflation forecast (T) Sanjay Malhotra RBI (T) GDP Great RBI (T) Rukh (T) Indian Bank Borrowing Rate (T) Liquidity Management (T) HDFC Bank Sakshi Gupta (T) Nomura Repo Date Forecast