Recently I got a call from an insurance company sales executives and they tried to sell me an insurance policy which they said had Guaranteed 11% Returns,

The policy was Reliance Nippon Life Guaranteed Money Back Plan

I knew that there is surely some catch and they are changed me, I didn’t know what exactly it was. So I Decided to Dive Deeper and Find Out More.

After I asked them tough questions, and on them realized that my knowledge about these things is very than an average uninformed investor, they were ready to mail me to mail me to Will get. Finally, I solved the mystery like cid and told them the policy has just a 4.6% return and not 11%.

Do watch the video below to quickly understand the whole game.

https://www.youtube.com/watch?v=g90V4iijarug

Guaranteed 11% Returns

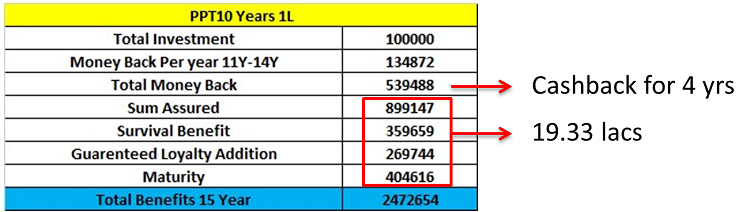

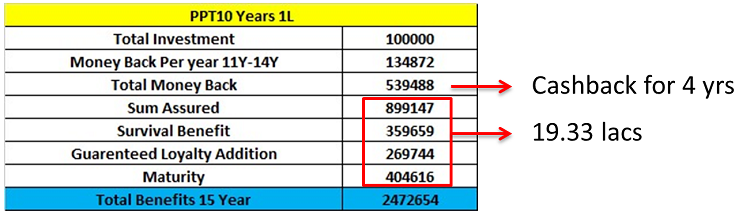

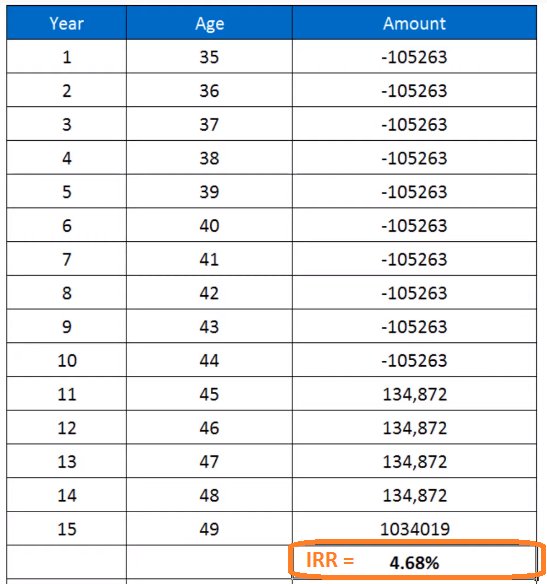

So when I get this sales call, a lady told me that this was a 15 yrs plan, for which the premium payment term is just 10 yrs. I will have to pay 1 lac for 10 yrs and i will get a total payment of Rs 24.72 lacs towards the end and the return turns out to be 11% irr

This sounds quite attractive and anyone who is not happy with the fd returns these days will get the attracted quite fast.

Here is the breakup of the Amounts she told me i will get in 15 yrs

I Told Her to send me an illustration and she did that after some time (Here is a pdf copy,

When I was the illustration, I saw that the premium was not Rs 1 lac, but it was Rs 1,05,263. This is the first thing that she is never informed me of. So instead of 1 lac, the outgo from investors pocket is Rs. 1,05,263!

When I LOKED Deeper, I Found Out that Few Numbers She Told Me Over the phone are visible in the illustration, but the amount of Rs 8,99,147 was missing from the Illustration. This was the sum assured Amount.

She had mentioned to me on call that we will get this sum assured amount also, but the illustration has no information about it.

This was the catch

So when I asked them – “Why is the sum assured not in the payment section?

To this one of the seniors told me that it’s not in the illustration, but I will get it trust “Sum assured is always in the policy”. I Told Him that it’s paid when a person dies, but where it is written that I will get the sum assured amount from apart from the other numbers he haad mentioned ”for why which he didn’t a clea a clea.

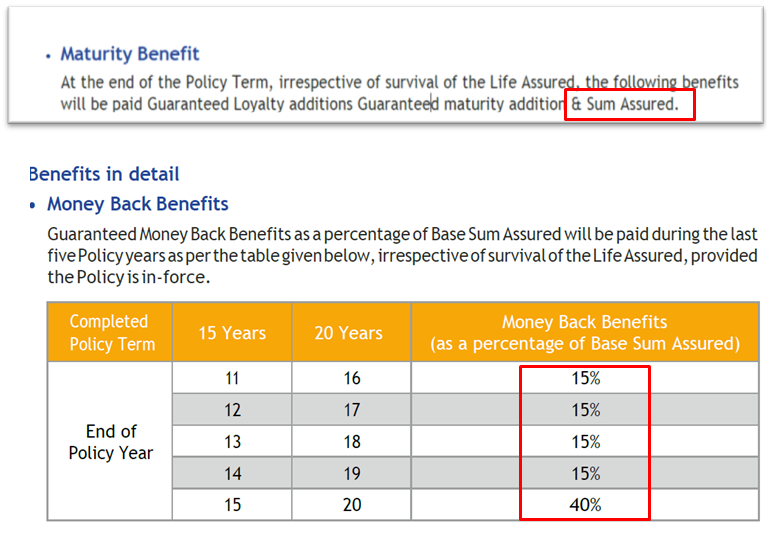

The sales guy kept telling me I will get it and finally, he told me that it’s mentioned in the policy brochure. When i look at the policy brocher, it was mentioned that it paid

but… but… but it paid in installments and that was the catch

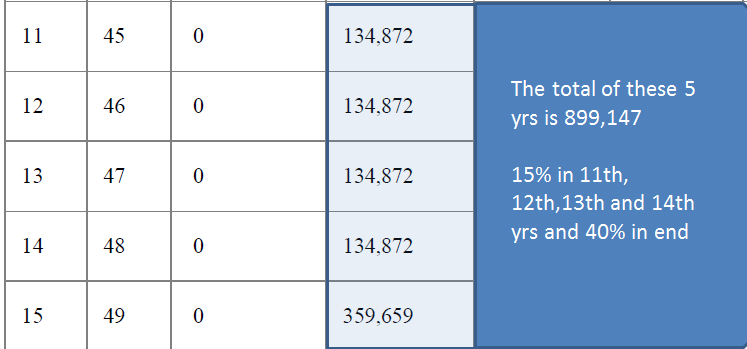

The sum assured is given to you in small parts in year 11th, 12th, 13th, 14th, and final in 15th year. So it’s alredy paid to you which you can see in the image below.

For thisveer these guys was also counting the sum assured against them told me about the plan over the phone and that’s the reason they are tell you that you will get a very big amount, who will not do!

They are just counting the same thing in the benefits and they are not even lying will they say

Are you getting the whole game? They are just saying the thing in an income and twisted format.

To properly understand the details, do watch the video above

This was a catch which most of the investors are not able to catch and believe the sales call.

They also don’t find any mistake or bluff and even thought they have heard that lots of missalling Haappen in the insurance sector, they still go with these policies.

IRR returns of just 4.65% instead of promised 11%

When I calculated the irr of the policy with the correct numbers, the IRR turned out to be just 4.65% raather than the 11%, they claimed over the call.

Conclusion

Do not fall for this kind of policies which does not clearerly give full information on the returns and is too complicated to understand. They will try to convince you by saying Given in written and if they say something like that, it will look very Trust Worty!

Just avoid it.

For your insurance needs, take a plain vanilla term plan and for your investments do investments in pure investments products like stocks, PPF, Mutual Funds, Bank FD’s, NPS, NPS, NPS, NPS, Etc, Etc, Etc, and Keep THNINGS SIPLE.