The ongoing covid-19 pandemic has caused a lot of fear and anxiety in our lives if there are no vaccines or any cure available for this problem. If anyone gets covid +ve there chances that there may be huge medical bills running into lakhs of rupees.

In case you don’t have big health insurance, you can go for a special policy called “Corona kavach policy” which got introduced recently in the market.

Irdai has come up With a Standard Covid Focused Basic Health Insurance Policy Know as “Corona Kavach Policy”, which I will be reviewing in this article.

Features of Corona Kavach Policy

- This policy is available on an individual as well as a Family Floater Basis.

- The minimum and maximum sum assured offered by the policy are Rs. 50,000 to Rs. 5,00,000.

- A person aged between 18 yr to 65 yrs can purchase this policy.

- This policy can be purchased for self, spouse, parents, parents-in-law, and dependent children of 25 yrs of age.

- 2 Types of Cover -Base Cover on Indemnity Basis which covers covid hospitalization cover and optional cover on Benefit Basis which covers Hospital Daily Cash.

- This policy has a waiting period of 15 days from the purchase of the policy.

- The tenure of the policy is 3 ½ months, 6 ½ months, 9 ½ months including including waiting period.

- Premium payment mode is single.

- Tax exemption on the premium paid u/s 80d.

What all is covered under this policy?

a) Hospitalization Cover –

If a person has tested covid +ve in a government authorized diagnostic center then the medical expenses and expenses incurred on treatment of any comorbidity along with the treatment for covid up to the sum insured above Covered under this policy provided the insured is hospitalized for more than 24 hrs in the hospital.

Let us see what all comes under hospitalization cover –

- Room Rent, Nursing Expenses, ICU, and ICCU Charges will be covered.

- Surgeon, ANSTHITIST, Medical Practitioner, Consultants, Specialist Fees With Paid Directly to the Treating Doctor/Surgeon or to the Hospital will be covered under the policy

- Expenses on Anesthesia, blood, oxygen, operation theatre charges, surgical appliances, ventilator charges, medicines and drugs, costs boards diagnostics, diagnostices, diagnostic imaging modalities, ppes kit, gloves, Mask, etc. .. will be covered under this policy.

- Ambulance charges up to Rs 2000 will be covered under this policy per insurer only if the Ambulance has been available in Relation to Covid Hospitalization. This is also include the cost of the transportation of the insured person from one hospital to another hospital as prescribed by a medical practice.

b) Home Care Treatment Expenses –

If a person is tested covid +ve in a government authorized Diagnostic Center and is getting treatment at home which normal courses will require care care and treatment at a hopital but is a hosal but is at a hosal but Maximum up to 14 days per increasent, then home care treatment

- If the medical practitioner has advised the insured person to undergo treatment at home with a Continuous Active Line of Treatment with Is Being Monitored by a Medical Practitioner for Each Day the Duration of the dog Care treatment.

- The insured or the family member should maintain a Daily Monitoring Charts Includes Records of Treatment Administerred and Duly Signed by the Treating Doctor.

- Cashless or reimbursment facility shall be offered under homecare expenses Subject to Claim Settlement Policy Policy Disclosed.

The expresses made related to the treatment of covid will be covered under this policy. They are as follows –

- Diagnostic tests underwent at home or at the diagnostics centers.

- Medicines prescribed in Writing

- Consultation Charges of Medical Practitioners

- Nursing Charges Related to Medical Staff

- Medical procedures limited to parenteral administration of medicine

- Cost of a pulse oximeter, oxygen cylinder, and nebulizer

c) Pre and post hospitalization Medical Expenses –

Pre-Hospitalization Medical Expenses of 15 Days Prior to Admission Into the Hospital and Post-Hospitalization Expenses of 30 Days after Getting Discharged Discharged from the Hospital will be covered Under this policy.

d) Hospital Daily Cash –

Hospital Daily Cash Benefit Comes under an additional cover if the insured has opted for optional cover on Benefit Basis. Under this benefit, the insured will get 0.5% of the sum insured per day up to a maximum of 15 days.

From where can I purchase this policy?

This health insurance policy Can be purchased from 30 general and health insurance companies. The list of these companies is as follows –

(Su_Table Responsive = “Yes”)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(/su_table)

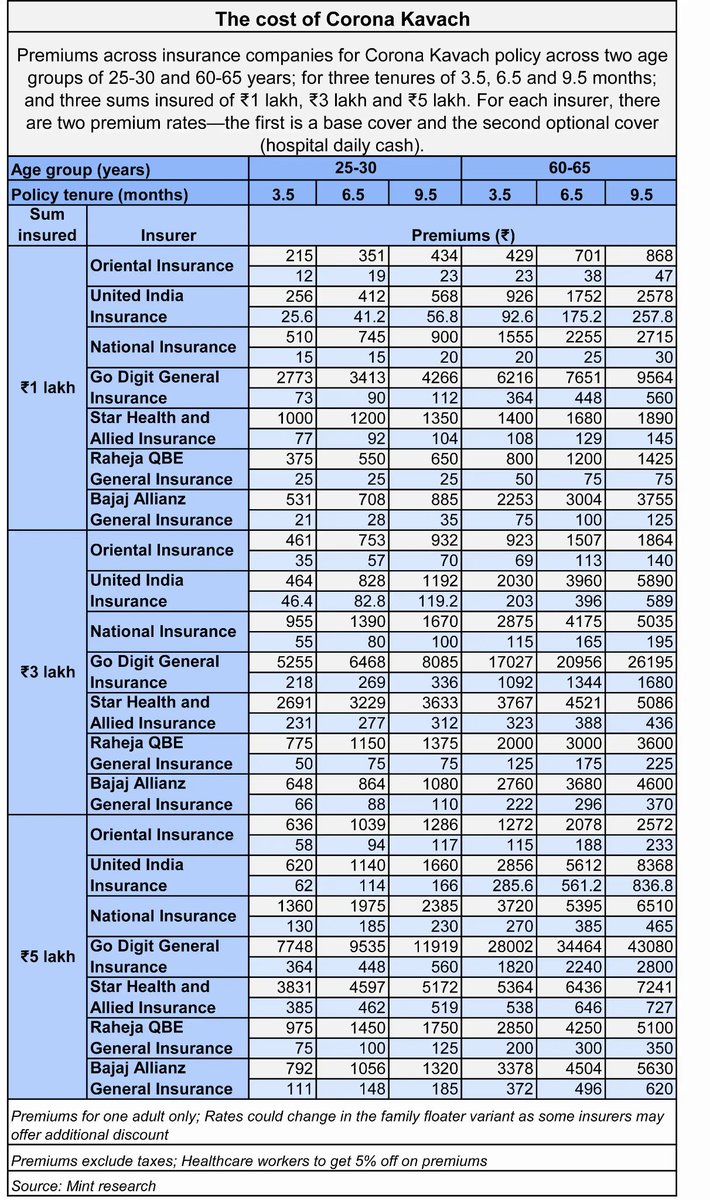

Premium for Corona Kavach Policy

Livemint research has done a detailed study of premium for various companies. Check out the premium table below.

Exclusion under this policy –

- If there is any diagnostic expenses made which are not related to covid, then that expresses will not be covered in this policy.

- If a person is tested covid +ve before the start of the policy, then this person cannot file a claim to the company.

- Expenses Incurred in Daycare Treatment and OPD Treatment will be excluded from this policy.

- If a covid +ve person is getting treatment outside India, then the expenses incurred in the treatment will not be covered under this policy.

- If any expenses incurred on un-proven treatment, procedures, or supplies related to covid which lacques medical documentation to support its effectiveness will be covered in this policy.

- If a person is getting testing done to covid in diagnostic centers that are not authorized by the government then the expenses incurred will not be covered under this policy.

- Expenses made on dietary supplements and substances which are purchased without prescription will not be covered under this policy.

A short video review of Corona Kavach Policy –

https://www.youtube.com/watch?v=Xsjlq9m0wi8

All features mentioned in this policy are referred from Irdai notification,

Conclusion –

So this was all that I wanted to share in this article if you have any queries you can put it in the comments section.

(Tagstotranslate) Health Insurance