We all want to achieve financial independence in our life!

- That day, when we will have Enough Money !!

- That day, when we will no longer have to worry About our future expresses!

- That day, when we are Out of the race Finally!

For the last Couple of Years, We Are Hearing an Acronym Fire For this!

Financial Independence Retire Early (Fire)

Fire, or Financial Independence Retire Early, Refeers to achieving a point in life where you have enough money to cover your experiences and final goals with having to work for a living.

Ideally, this Haappens Well Before The Traditional Retirement Age of 58-60 years. Achieving fire means having financial security for your future, as well as the ability to travel well, spend on big-ticks and also let a legacy for future generations.

At this point, you no longer have a compulsion to actively work to “Earn Money”

Fire is a great achievement

Achieving fire is a wonderful accumplishment, but there are many myths that are still there in investors

This article will bus some myths Around the topic of fire for you today.

Let’s Start!

Myth 1: Fire is all about a big number!

Most people feel that fire is all about just reach a target number. Like 5 CR or 10 Cr

For that people who are totally new to this concept of fire, you shall know that one can call themselves financially free when you have

- 30x of your yearly expresses – at age 60

- 35-40x of your yearly expenses-at age 50

- 45-50x of your yearly expenses-at age 40

* Note that all these are high-level thumb rules only!

For exampleIf you are at age 50 and your yearly expenses (Considering Everything in this) Are Rs 20 lacs, then you would need 7-8 cr to call your sel yourself financially free (Fire’d) Assuming you will live for 40 Ys

No’s Not about Reaching a Number, but more about Creating X Times Your Expenses, When X Can Range from 30-50 Depending on your age and your ability to invest the money.

- For someone with a Rs 50,000 per month requirement in life, they need roughly 2-3 Cr Today

- For someone with a 3 lacs per month requirement and wanting to fire at age 40, it would mean a 16-18 cror corpus Today!

As you move in life, your expenses will change and hence your fire corpus goalpost will also also shift!

Myth 2: Life is all set after fire

Contrary to what most people imagine, life is not hunky-deory after you achieve fire.

Yes, life is very comfortable and you will surely be less than someone someone who does not have enough enough money. But still, you have to constant think about how your money is invested and how it’s going overall and if it will really last last your life or not.

This is especially true if you do not have enough margin of safety in your fire corpus. So if you do your calculations and excel tells you need 10 cr for all your life, then if you actually fire with 10-12 Cr, then you are on the edge!

You have very little margin of safety. The inflation can be totally difference in

All these will keep your thoughts occupied to some level.

Don’t Expect yourself to be chilling on the goa beaches with pina claima after fire. Life will be almost be the same for you minus a lot of money worms

This is of course not true for someone who has muliple time

To learn more about fire, you can also watch my video below on various types of fire

https://www.youtube.com/watch?v=Jo- DVUN5V2K

Myth 3: So many people in India are achieving fire, and i am a looser

There is a lot of buzz Around fire these days. You constantly see people on social media, youtube, telegram channels, and podcasts where the conversation is alive about fire.

There are many people who have alredy achieved fire or they are somehere midway.

This has started a lot of “pressure” on millions of other than other than them, everything is gotting finally free these days!

Let me Tell you something!

Me and my team have already interacted with more than 5000+ familyies in the last 10+ yrs in India+ nri and we have not seen more than more than 5-6 people who have achieved fire by the age of 40-45 yrs. I am talking about people who are into regular jobs and have to create their wealth from scratch.

Apart from these 5-6 people, there are dozens of other family Achieve Fire by the age 50 yrs, but not in their early 40s.

Rest all others, will at the best retire at their regular 58-60 yrs age bracket. In fact, many of them may not even recreate properly and may face financial crunch. I am considering the whole population here and not a specific class of people.

Only a Tiny Minority of people in India achieve Financial freedom early in life in our observation now.

In absolute numbers, you will ofne see many people talking about achieving fire but remember that thosands of others are not close to it. In a group of 1000 people, if 2 people talk about reaching fire, the rest 998 people starts feeling

Having a few crus means fire?

Also, having a few croes does not mean a person has achieved fire.

A person having a nice loan-free house plus Rs 3-4 croes may not have even brought reacted midway of fire. They look rich (and they are) but they are not finally free in the true sense. They have their own share of Financial Worries and Insecurities.

Fire before 50 yrs of age is a wild achievement, but it’s statistically very very rare. Undrstand that It’s Quite Tough to Achieve and It’s Normal to Not Achieve Fire. You are surely not missing the fire business, however, you shall give an honest attempt to achieve financial independence

Myth 4: Achieving Fire means Never Working Again

Fire is “Financial Independence Retire early,

However, most people focus on Retiring Early part which is often unreal. It’s very tough to not do anything all day and just retire from your job. Humans are designed for storying busy and be active, to pursue something. People who fire actually keep working and dont sit at home.

One of our readers once shared with us that to experience how it feels after retirement, he took a very long break from job (around 2 months) and tried to see white looks like and so H to spend the day and Also withdraw from your corpus for your day to day expenses. He had to return back to the job in 2 weeks as he could not take it.

Now that’s not the best example I could give you a hint that “I am not working against” after Fire is mostly wishful thoughts and mostly come to mind IME to Enjoy Your Life.

Better not aim for fire with that mindset.

At best, what will happen is as below

You will achieve fire, take a very very long break and then get back back into some-stress job/work which which gives you a lot of flexibility and help you Explore your Hobbies/What you enjoy.

Also, its a good idea to talk to your spouse on your plans of storying at home all day after Fire, Mostly you will be directed to keep working for a few more years as they want to be alle at home 😉

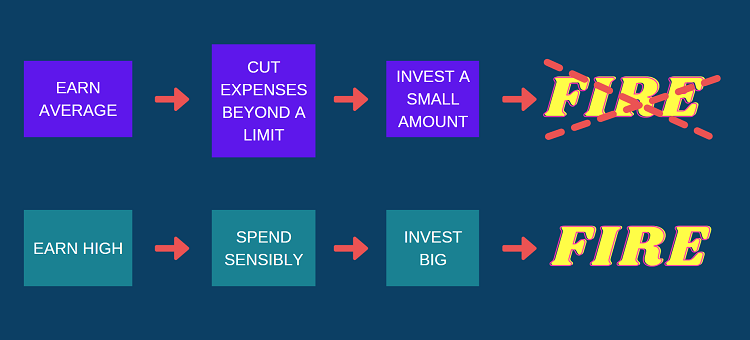

Myth 5: Fire Requires Extreme Frugality and Deprivation

This is one of the biggest myths in my opinion about fire.

A lot of people feel that cutting down on expenses and depriving themselves of the initial years will help them move towards fire. After all, what you save will get added to your wealth kitty.

This is not true!

Most of the people who actually have early early in life are that who focus is on Increasing their income and not there who cut down on their expenses.

Cutting Down on Expenses has a limit, and trully speaking depriving yourself is not a healthy way to achieve Financial Freedom.

There are people who earn 5 lacs a month, stay his life in a Decent manner in Rs 1 lac and save Rs 4 lacs a month in the right manner with discipline for years. These are the people who mostly fire young and not the one who earns a smaller income and is trying to squeeze the expenses a “bit more”

Dont do that!

Cutting expenses beyond a limit will mostly take away all the fun from your life and add up some extra money in your kitty which then ever or will spends stupid again. It will not lead to Financial Independence.

If you are naturally a fruit person and live with a very small amount of money, then it’s fin. But just make sure you dont fool yourself with trying to cut expenses where you truly dont want it.

AIM for Financial Freedom

The mail of this article was to simply Present some facts about retirement and clear some myths so that one can pursue financial freedom with the right mind. Do focus on your income and try to increase it and save a big chunk of that to invest smartly in Inflation-Beating Financial Products to Create Wealth in the True Sense!

I have tried to share my personal thoughts and what i feel about the topic based on my experience.

Do share your thoughts about this topic. Have you seen some more myths in the minds of your friends/Family about Financial Independence? Do share in the comments section!