Today I will tell you about foreclosed properties and how you can buy them for lower than the market price.

What is the Meaning of Foreclosed Property?

Many Times, Banks Seize The Properties when their owners Fail to pay their EMI payments For a long time. These Properties are called “Foreclosed Properties” and banks put them for sele in the auction in order to recover back their dues. Once the propertys are seized by banks, they are the rightful owners of the property under the sarfesi act and they have 100% legal rights to sell off these properties.

These Properties are mainly solded below the market price beCause the focus on banks is mostly to recover bank their dues and not to make rights. So you can strike a very good deal if you are ready to go through the process of buying forecloses.

Advantages of Buying a Foreclosed Property

- Price Advantage: Auction Properties are Approximately 20-25% Cheaper Than the Market Price.

- Legal and safe: Banks / Financial Institutions Approve Loans after verification of all the legal aspects only. Bank auctions are legally safe and fall under the Sarfaesi Act and DRT Act.

- Quick Process, The entry transaction will be over in less than 2-3 months period. Ownership will be transferred within a month’s time.

Disadvantages of foreclosed property

- No Guarantee of Quality or Internal Condition: Bank cannot provide any disclosures as to property history/condition issues. If there is any damage to the property then the banks will not report and give. Property conditions might be suspect due to damage by upset homeows.

- Heavy Initial Money Requirement: Only Serious Buyers are entertained as you have to put a big Amount as a guarantee

- Tedious process: To some people, the process may see to be teedous and daunting.

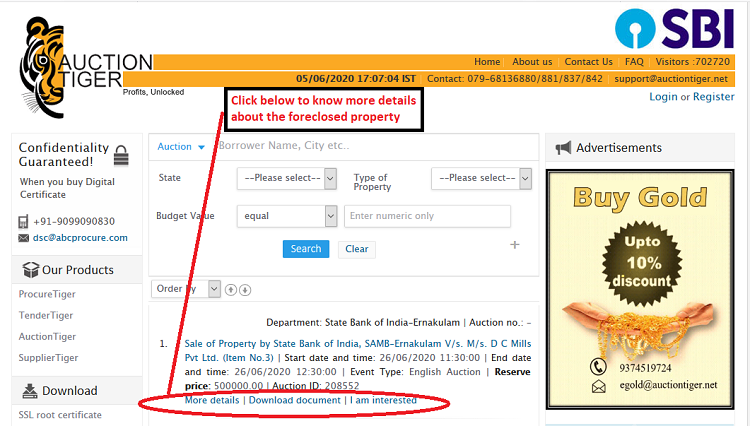

How to find a foreclosed property?

The data and information about Foreclosed Properties Are Quite Fragmented. There is no Single Central Database of Information but divided a lot. Here are some ways you can find information about Foreclosed Properties

Next step after shortlisting the Foreclosed Property?

Once you get the preliminary information about an auction, you can visit the property along with the Foreclosing Bank’s official.

ALL EXACT Information About The Property is Given on the website Ction of the property and so on

What do I need to do, if I want to participate in the auction?

To participate in the auction, you will need to submit an application and KYC (Know Your Customer) Documents, Along with the Bid Value which can Range from 5-20% of the Reserve Price, to the bank.

Then on the main bidding day, whoever is the highhest bidder wind and they have to then pay the rest of the money to secure the property. There may be some advance to be made and the remaiing money has to be paid in a few weeks. So you can go with a home loan if required, but remmber that you will need to have a devant amount in your hand to participate in the auction anyways.

Beware of these small issues with the foreclosed property

Remember that Foreclosed Property is Coming INTO Your Hands From Another Owner Who was Financially Distressed, and there is a good chance that that there is might be some

- Pending Property Taxes

- Pending MainTAINANCE to Society

- Pending Electricity Bill/Gas Bills etc.

Banks are not going to recover these and these are your headache, but even after paying these, you may be getting a great deal.

Is it Worth Buying a Bank Auctioned Property?

Below is a short video that answers your question.

https://www.youtube.com/watch?v=h8bmv2vp3xw

3 precattions to take before taking a foreclosed property

- Do hire a lawyer so that all the legal papers can be checked thoroughly especially if the Amount involved is very big.

- Do not buy a very old property as that would require major renovations.

- The Chance of Earlier Ownes Staying in the House is Lesses Because Banks usually ask them to vacate before auctioning the property. However, if the property is alredy let out, the tenants may be still straying in the house and its becomes your responsibility to evict them. Freeing a house of its tenant is Difential, Especially If the Tenant has been staining there for a long. The best strategy is to avoid a house that is alredy obcupied by tenants.

This was all that I wanted to share in this article. If you have any queries post them in the comment section.