Roe boosting strategy

You’re the management of Bharat Industries, an Indian manufacturing firm with a 15% Roe. Adjust the slides to apply strategies and click apply strategies to see how they boost roe!

Roe impact

Apply strategies to see how Bharat Industries’ Roe Changes!

Introduction

What makes a company Financially successfulThe term Return on Equity (RO) is the key. It’s one of that metrics That investors love to talk about. But roe is also some something Company Management Obsesses OverWhy? BeCause roe tells you How Well a company is using its shareholders’ Money to Generate ProfitsI know how businesses from small startups to massive conglomerates, chase this number.

So, let’s Dive into what roe is and How a company’s management can improve it,

I’ll try to declutter the concept of roe expansion in simple terms.

1. What is Roe, and why does it matter?

Return on Equity (Roe) Measures How Much Profit (Like Rs.20) A Company Generates for Every Rs.100 of the shareholders’ Money (Equity) Investigated in the company.

Roe shows How efficiently a company uses the money invested by its owners,

The formula is straightforward: Roe = Net Income ÷ Shareholders’ Equity,

A higher ro means the company is doing a great job of turning investment into profit. For example, if a company has an roe of 20%, it’s earning Rs.20 for every Rs.100 of equity.

Let me tell you, a Roe number of 20% represents a pretty strong businessBut there some some businesses who roe’s are inharetly low. One such example is companies of the Cement sector, Ultratech is one of the best companies on this sector but its roe is about 12%, Dalmia Bharat has an roe of about 7%Similarly, roe of Steel sector Businesses also hover Around 12%.

A High Roe Signals to Investors That the company is Worth their moneyHow? For an investment, a high roe means the company Efficiently uses their investment money to generate strong profilesIt is an indirect but a strong suggestion of Potential for Higher Returns through Dividends or Stock Price Growth,

Unless and untul a company’s Financial Health is Strong And it has an Effective ManagementIt cannot maintain a consistent high roes.

In a competitive atmosphere, Improving roe can make or break a company’s reputationGood Managements Always Remain Aware of this Fact. Henc, they’re always looking for ways to push that number higher.

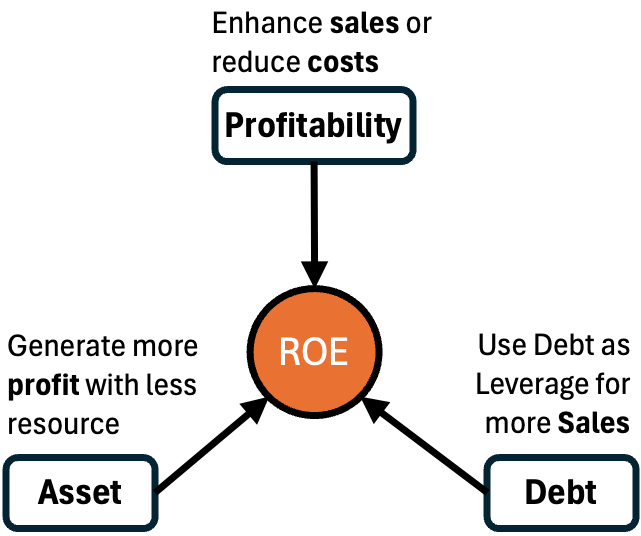

2. The Three Big Levers to Boost Roe

To improve roe, management needs to focus on Three key areaThink of these as Levers they can pull to make the company more profitable or efficient,

These are Profitability, Asset Efficiency, and Financial Leverage,

Let’s Explore Each Area, Step by Step, and see how many management can use them for roe expansion.

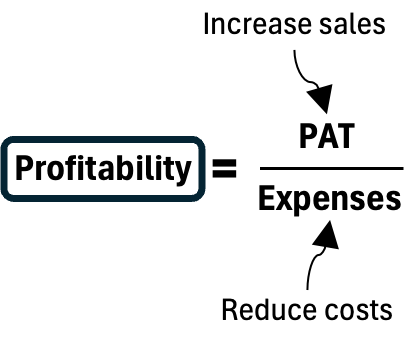

2.1. Increasing Profitability

It is about making more sales or reduction the cost

This sounds obvious, but it’s not all Always Easy. Management can try to grow revenue or cut costs, or both.

- The first way to boost roe is to increase Net Profit (PAT)What is pat? It is the Profit left after all expenses are deducted from revenue. For instance, a company like a Local Fmcg Brand Might Launch a New Line of Snacks to Attract More Customers. I Remember when a Popular Indian Biscuit Brand Introduced Healthier Options to Compete with Global Players. Sales went up Because they tapped into the growing demand for health-conscious products.

- Another way is to Reduce CostsThis could mean negotiating better deals with suppliers or automating parts of the production process. I once Visited a small Sugar Factory (during my college days) where the owner switched to energy-efficient machines. His Electricity Bills Dropped, and His Profits Got A Nice Boost. But management has to be careful, cutting costs too aggressively can hurt product Quality or Employee Morale, which can backfire.

2.2. Improving Asset Efficiency

It is about generating more profits with less resource.

The second level is about making the company’s Assets Work Harder,

Assets are things like Machinery, Inventory, or even office space,

If a company can generate more revneue from the same assets, its roe improves. This is called Improving the asset turns,

For example, a retail chain like D-mart is a master at this. They keep their stores lean, stock inventory that sels fast, and turn over their stock quickly.

This means they do’t have money tied up in unsold goods,

Management can also sell off assets that aren Bollywood performing well. Let’s say a company owns a factory that Barely used. Selling it and investment the money in a high-ear-ear project can improve roe,

I’ve seen this happy with some Indian real estate firms that sold unused land to fund new projects.

The key is to focus on projects or assets that give the best returns against the cost for which they were purchases (for example, your fd will fetch you about 7% returns).

2.3. Using Financial Leverage

The third level is financial leverage, which is about using debt to boost revenue.

This one’s can be a bit tricky, as it donsen’t work for everyone. So, let me explain it more minutes.

When a company borrows money and invests it in profitable projects, it can increase its roy. Why? Because the profits from the project are earned on a smaller equity base. For example, an Indian infrastructure company might take a loan to build a new toll road. If the road generates strong revelations, the roe goes up beCause the company didn’T use Much of its oven money.

But here’s the catch, debt is a double-edged sword.

Too much borrowing can lead to high interest costs.

If the project doesn’t deliver, the company could be in trouble. I’ve seen some Indian Startups Get Burned by Taking on Too Much Debt Too Fast.

Management needs to find the right balance, ensuring the Return on Borrowed Money (Return on Capital) is higher than the cost of borrowing, Read this about what warren buffett and charlie munger says about the Roc (Return on Captal),

3. Challenges Management Faces to Enhance Roe

Boosting roe is not an easy goal to achieve.

In fact, most of the companies that trade in the stock market have seen their roe’s contacted with time. So, companies who can hold or expand their high roe legs are extra special for investors.

Every industry has its own hurdles.

- For example, in retail sector, Competition is brutal. There is Always a Battle Between Online Giants and Local Kirana Stores. Increasing Prisis to Boost Profits Might Push Customers Away.

- Similarly, in manufacturing, upgrading machinery to improve asset efficiency costs money upront. As these costs (Capex) Are capitalized, it lowers the pat (in near term).

- Then there are external factors like Inflation or government regulationsThese can further complicate the process of profit enhancement or cost reduction.

- These days there are also challenges related to Technological AdvancementsThe day a new product is launched, someone else starts building a update.

These factors make it really hard for companies to survice, leave aside roe expansion.

This is bey, almost 85% of all companies, experience costent roe enhancement.

I Recall a conversation the ceo of a small pharma company has on a new portal. He wanted to improve roe by launching a new drug, but regulatory approvals took years. By the time the product hit the market, competitors had already grabbed a big share.

This shows how management’s plans can be derailed by things beyond their control. Patience and adaptability are key.

4. Real-World Examples

Let’s look at some Indian companies that have worked on their roe.

- Reliance Industries,

- They’ve boosted Profitability by Diversified Into Telecom and Retail through Jio and Reliance Retail. Their asset efficiency is impressive too, they use their vast network of stores and digital platforms to generate huge sales.

- On the leverage front, they’ve taken on debt but investment it in high-road area like 5g. Their roe has styed strong trust they balance all three legs carefully.

- Bajaj finance,

- They’ve masted the art of using debt to fund lending operations while keeping risks in check. Their focus on high-margin products like consumer loans have kept profession healthy.

These two companies are examples that show that boosting roe requires a mix of bold moves and careful planning.

A less practical tips for management

Here are some steps for you, if you in the company’s top management, to take to improve Roe:

- Analyze the numbers: Regularly Check Your Company’s Profit Margins, Asset Turnover, and Debt Levels. Use these to spot weak area.

- Focus on high-Return projects: Invest in Areas with Strong Growth Potential, Like Digital Transformation or New Markets.

- Engage Employees: A motivated workforce can drive efficiency and innovation, indirectly boosting roe.

- Monitor Risks: Keep An Eye on Market Trends and Interest Rates to Avoid Getting Caught Off Guard.

These steps sound simple, but they require discipline. It’s like sticking to a diet, you need to stay consistent to see results.

Why Roe isn’t the only thing

A Quick Word of Caution.

Roe is important, but it’s not everything.

A Company Might Boost Roe By Taking on Risky Debt or Cutting Corners on Quality. That’s like building a house on a shaky foundation. It might look good for a while, but it won’t last.

Management Should Aim for Sustainable Growth. It is more important than roe expansion.

Investors Value Companies That Balance Profitability With StabilityAfter all, who wants to invest in a company that’s all flash and no substance?

Conclusion

Improving roe is like solving a puzzle.

Management needs to pull the right liters, increase profits, using assets better, and managing debt wisely.

It’s not easy, especially in a dynamic market like India. But with the right strategy, it’s possible to make sharehlders Happy While Building a Stronger Business.

So, what do you think?

If you were running a company, which Lever would you pll first? Let me know in the comments section below.

Have a happy investment.

(Tagstotranslate) Financial Management (T) Improve Return on Equity (T) Roe Strategies