Wealth Milestone Calculator

Plan Your Journey to Financial Independence and Wealth. Enter Your Monthly Expenses, Savings, and Preferred Investment Style to Discover Your Personalized Wealth Milestones and Timeline.

Your Wealth Journey

Your Investments Grow Over Time With Consistency Contributions. Begin today and let compounding build your wealth.

Introduction

If you are reading this, it means you too is a probably a salaried person (Like me, I was once in that boat – Read about me hereI know where it means between jugging bills and dreaming of Financial Freedom.

Maybe you earn Rs.50,000 a month, but 90% Goes to Rent, Groceries, and Emis. That leaves just Rs.5,000 to save. Can you really get rich with kind of Saving? I used to wonder the same. But I’ve Learned IT’s Possible With A Plan, PATINCE, and Smart Investing.

Let’s talk about how you, a regular person doing a normal 9-5 job, can build serial wealth.

But before that, lets declutter what it means to become rich.

What does “rich” mean for you?

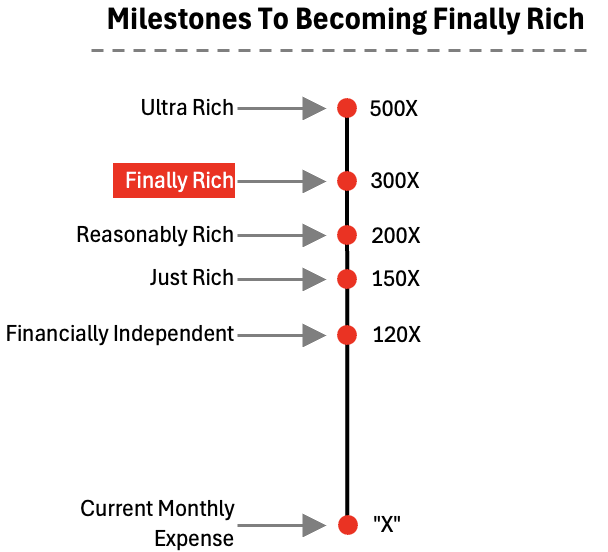

Wealth isn’t just fancy cars or big houses. It’s about freedom from money worms. I like to measure it based on your monthly expresses,

Say your expenses are Rs.50,000 per month.

- You need a portfolio 120 times That, Rs.60,00,000, to be Financially independentWhy? At a 5% return, it generates Rs.50,000 a month without touching the Principal. That’s freedom. What is the significance of 5% – in India, we can generate this return almost risk free.

- Want more? A portfolio of Rs.75,00,000 (150x) Makes you “just rich“With extra cash for comfort.

- At Rs.1 crore (200x), You’re “reesonally rich“Enjoying luxuries like travel.

- At Rs.1.5 crore (300x) You are finally “rich,

- And at Rs.2.5 crore (500x) is “Ultra rich,

Sounds daunting, right? But every journey starts with a single step.

See your wealth goals clear

Before we dive in, let’s make this personal.

How much do you need for these millstones? What will it take to get there?

Try our Above Wealth Milestone CalculatorEnter Your Expenses, Savings, and Investment Style. It’ll show your targets and timeline in a clear, personalized way.

Why equity is your best friend

You might think Rs.5,000 a month can’t make you rich. But equity investments can change that.

Stocks and Mutual Funds Have Beated Other Assets for Decades. Over 10 years, large-cap Mutual Funds Give 12–13% returns. Multi-cap Funds can hit 14–17%. Compare that to Fixed Deposits at 6–7%.

Equity Grows Your Money Faster.

I sugged putting 80% of your Savings in Equity Mutual Funds and 20% in Direct Stocks. Why this mix? IT Balancs growth and safety,

- Mutual Funds Spread Risk Across Many Companies.

- Stocks Give you a chance for higher returns.

Togeether, they’re a powerful tool for salaryed folks like us.

The magic of mutual funds

Mutual Funds are a Lifesaver for Busy Professionals,

They’re managed by experts, so you don’t need to study markets daily. You can start a systematic investment plan (sip) with just just Rs.500 a month. Online platforms can make the investment process really simple.

Plus, if you opt for it, Equity-Linked Savings Schemes (ELSS) Save you up to Rs.46,800 a year in taxes under Section 80C,

What funds should you pick?

- Large-cap fundsLike SBI Bluechip, Are Stable, Giving 12–13%.

- Multi-Cap FundsLike Parag Parikh Flexi Cap, Offer 14–17% by investment across big and small companies.

Both are great for steady growth. Start with these, and you’re alredy ahead.

Adding stocks for extra growth

Why Bother with Direct Stocks?

They’re like the spice in your portfolio. With 20% of your savings, say Rs.1,000 a month, you can buy shares of solid companies.

Imagine Including Companies like Britannia, Eicher Motors, Bajaj Auto, ICICI Bank etc. your investment portfolio. These blue-chip stocks can grow 12–14% over time (if the time Horizon is longer, returns can be better).

Mid-cap stocks, like that from from companys like polycab, dabur etc. can push the returns to 15–17%, but they’re riskier.

How do you choose quality stocks,

- Look for Companies with Steady Profits and Low Debt. You can also my “Stock engine“To do a Detailed Fundamental Analysis of Stocks,

- Don’t chase hot tips or penny stocks. That’s gambling, not investment.

- Stick to Quality, and Hold for the long term.

Small Savings, Big Dreams

Let’s be real. Saving Rs.5,000 a month feels tight when Rs.45,000 goes to expresses.

But small savings compound over time.

Imagine Investing Rs.4,000 in Mutual Fund Sips and Rs.1,000 in Stocks Every month. At a 12% return, you could hit Rs.60,00,000 in about 22 yearsThat’s financial independence.

Want to speed things up?

Cut one restaurant meal or cancel an unused subscription. Even Rs.2,000 More A month makes you real the goal 3 years ear19 years,

You can also try a side hustle. Freelancing on platforms like upwork can add Rs.5,000 to your savings. Remember, Every Rupee Counts. Theose Extra Rs.5000 can make you reac your goal in 16.5 years Instaed of 22 years.

Make the most of Indian Opportunities

India’s economy is growing fast. The Sensex have given ~ 13.5% Annual Returns Over 20 Years.

Digital platforms make investment easy and cheap. Zerodha Charges Low Fees, and Apps Like Groww Are User-Friendly. Plus, tax-saving options fit salaried budgets.

- Consider ELSS Funds for tax benefits.

- The National Pension System (NPS) Offers equity exposure and saves tax.

- Public Provident Fund (Ppf) Gives 7-8% tax-free returns.

Togeether, these make a great recipe for diversification.

But keep most of your money in equities for faster growth.

Watch out for challenges

Building wealth isn’t all smooth.

- Inflation In India, Around 5–6%, Eats Your Savings. That’s who low-earlon options like Fixed Deposits Won’T Cut It.

- Markets can be valatile Too. When stocks Dip, it’s tempting to panic. But stay calm. Equity rewards those who hold for 10+ years.

- Your biggest challenge is Limited SavingsWith only Rs.5,000 a month, patience is key.

- Don’t fall for Get-Rich -Quick SchemesThey’re Risky and often Scams. Focus on Steady, Disciplined Investing. That’s how real wealth grows.

Patience pays off

I know you, me, everyone else would love to get rich fast. Who does not?

But wealth building is a marathon run, hence at fast pace you will never bring the end.

With Rs.5,000 a month at 12%, Financial independence Takes 22–25 years. BUMP Your Savings to Rs.10,000, and it’s ~ 16.5 years.

If you want to grow faster, choose Riskier options and stick to it no matter What. For example, Choose Multi-Cap Funds which can offer about 17% Returns (CAGR), and it could be ~ 17 years.

Once you hit 120x, compounding makes the next millstones Easier,

Here’s the Truth: Every month you delay adds time. I Started Small, with just just Rs.2,000 a month in sips. It felt like nothing. But 10 years Later, My portfolio is growing steadily. Start today, even if it’s Rs.1,000. You’ll Thank Yourself Later.

A few smart moves to start

Ready to begin?

Open a demat account, contact your bank now. It will take only 10 minutes to talk to the bank executive.

Start a Rs.4,000/month sip in a multi-cap fund. Put Rs.1,000 in a blue-chip stock like tcs. If you are not comfortable with direct stock, investment in a focused fund (Like HDFC Focused 30 Fund).

Automate Your Investments to Stay Consistent. Check Our Budgeting Guide to save more. Or explore Side hustle ideas For extra income.

Worried about Risks?

Diversified Across Funds and Stocks. Review your portfolio on a year, but don’t tinker too much.

Compounding Needs Time to WorkAnd avoid Chaising trends. Slow and steady wins this race.

Conclusion

You don’t need a big salary to build wealth.

You need a plan and discipline.

The Wealth Milestone Calculator Shows your path clearing. Try it again if you haven’t.

What’s your first step? Maybe it’s starting a rs.500 sip or cutting one experience.

Share your plan in the comments, i’d love to hear it.

Have a happy investment.

(Tagstotranslate) become Rich (T) Financial Independence (T) Get Rich (T) Job (T) Salaried (T)