A lot of investors are quite worked that they do not get same-day Nav when they invest in mutual funds? There are days when markets are down by 1%, 2%, or even 3-4%, and it’s a great opportunity to invest in equities at Lower Nav! ..

Forge Due to the Recent Changes by Sebi, Now the Nav is Allotted on the Realization of Funds by the Fund Houses Before The Preschibed Time of 3 PM.

This simply means that most of the investors are not available to get the same-day nav (except in a few cases). This frustrates the investors and they feel they are losing out on this Opportunity because markets may go up the next day and they will not get a lower Nav.

In fact i am also seeing many articles and youtube videos Teaching Investors – “How to get Same-day Nav in Mutual Funds” Without even undersrstanding if it’s will the effort or not. There are some ways through you get only you-day Nav like if you invest through amc portal directly or investment using upi in the mfu platform or investment verry early by 10 or 11 am so that will your money reaches am

But is it really worth the effort?

So we thought of doing a small study on this topic and investment if investors are really losing out a lot or not?

In our study, we found out that the same-day nav or next-day Nav does not matter for investors over the long term and it has almost no impact on their wealth creation in equity funds.

Now let me share some stats and what we found

For this study, we will pickle 3 equity funds that are quite old, which was

- Icici pru discovery

- Franklin prima plus

- Birla Equity Hybrid 95

Also, these are at least 18 yrs old funds and we downloaded the Nav of these 3 funds Since Since Inception. We have the data for a total of 4350 Nav points.

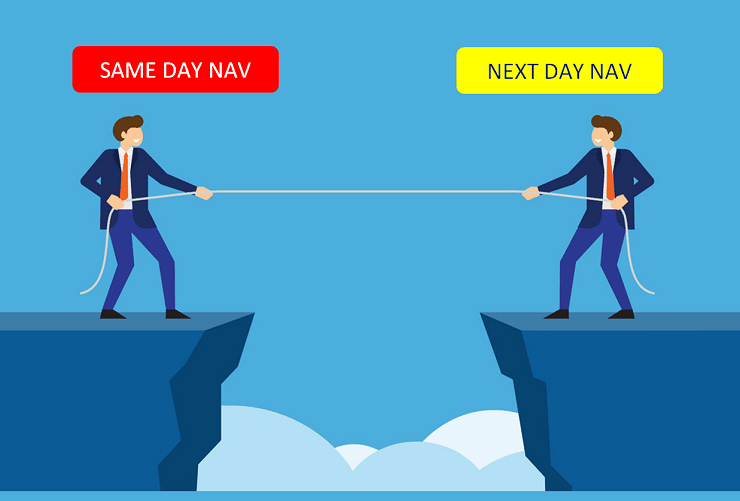

As a next step, we assume that there is an investor who wants to invest when markets are down. For that, we pickled all the days when nav of these funds came down by 1%.

Then we also found out how many times nav of that fund was again down the next day !! Let me show you the data

So if you look at the nav data of ICICI pru discovery, there was a total of 543 out of 4350 days when you was down by more than 1%.

What happy the next day?

- 258 days, the fund Nav was up with an average upmove of 1.02% (Average of that 258 days)

- 285 days, the fund Nav was down with an average downfall of -1.37% (Average of that that 285 days)

This simple means that on average, the next day Nav was done day of investment and it was a good thing the next day’s Nav rather than the same day’s nav.

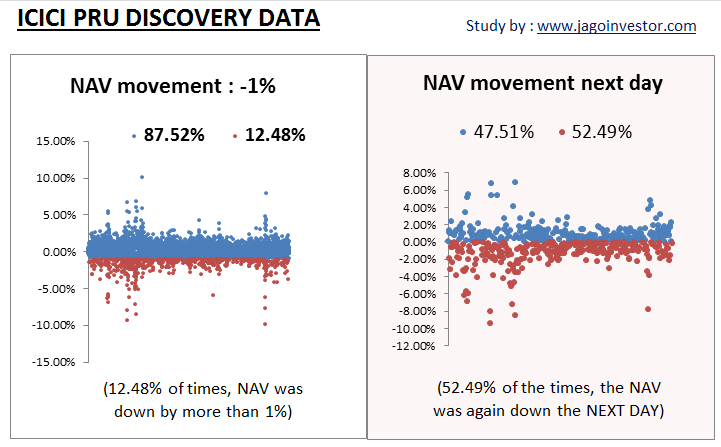

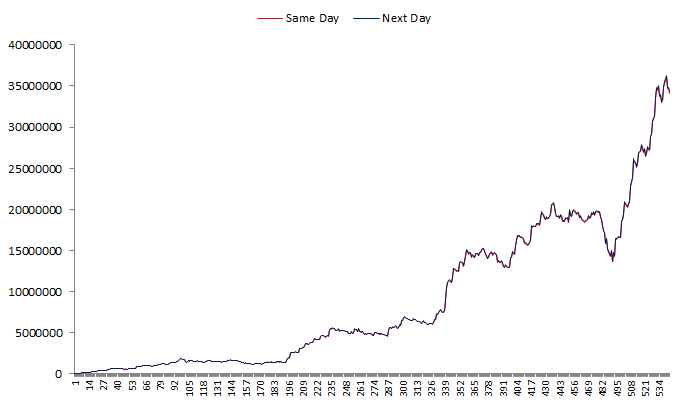

Same-day nav or next-day Nav? Which Created More Wealth?

Let’s assume that a person invests Rs 10,000 in the fund whenever Nav of the fund is down by more than 1%, then there are two cases ..

- Case 1: Investor Same-Day Nav

- Case 2: Investor Gets Next-Day Nav

We found out that wealth created was more in case 2 actually, however, the difference was not significant enough to brag about. Let me show you the numbers

- Case 1: Investor Same-Day Nav: Rs 3,47,08,084

- Case 2: Investor Gets Next-Day Nav: Rs 3,48,48,780

The difference between the same same-day and next-day nav is roughly 0.41%, so by getting next-day Nav the Investors Create 0.41% More Wealth, In this Particular Case, It was touched – Day Nav

Let me also show you how the wealth will increase over time in bot the cases

If you look at the graph above, there are actually two charts. The red line is the growth of weight And there is a black line that shows the next-day Nav case. You can see that both the lines are so close that you can literally just see one single line.

Data with the other two mutual funds?

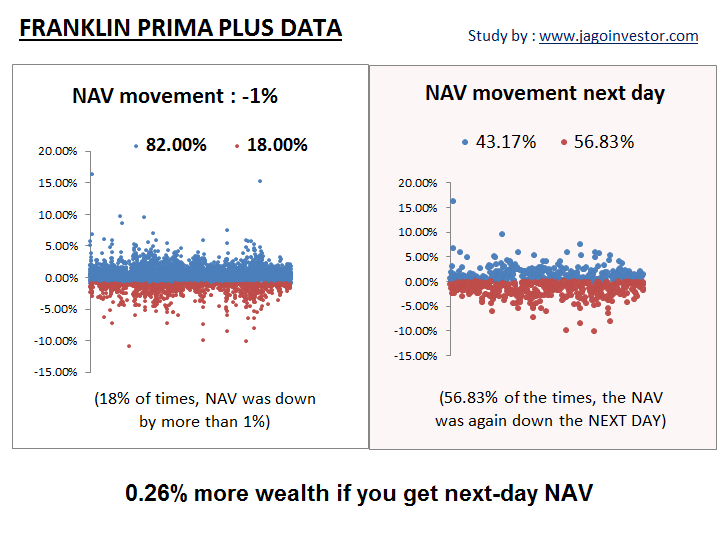

Let me also show you the same study results with franklin prima plus and birla equity Hybrid 95 Fund.

Incase of franklin prima plus, whenever nav was down by more than 1%, the next day Nav Fell Again 56.83% of the time and it was more probable to get a number Nav IF IF IF One GOT THE NEXT DAY GOT THE NEXT DAY Nav.

Investors Created Roughly 0.26% More Total Wealth By Getting The Next Day’s Nav

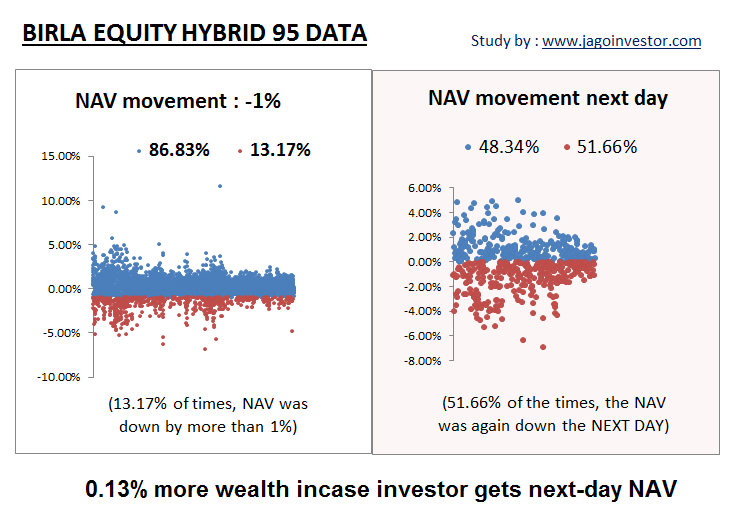

In the case of the birla equity Hybrid 95 Fund Whenever Nav Was Down by more than 1%, the next day Nav Fell Again 51.66% of the time and its more probable to get a better Nav If you are got the next day Nav.

Investors Created Roughly 0.13% More Total Wealth by Getting The Next Day Nav.

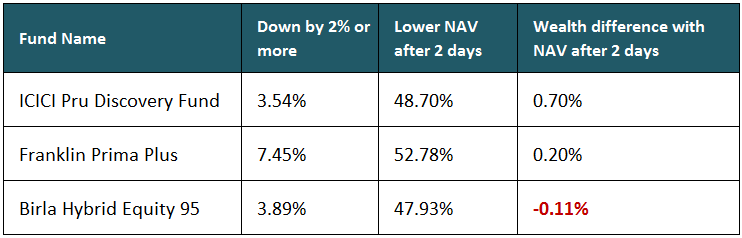

Markets down by more than 2% and one Got Nav after 2 Days?

Let us also see what if we changed the data a little bit. What If One Invested when Markets were down by more than 2% and one Got Nav after 2 Days (Not just the next day)?

If this Haappens then how will data change?

You can see about that even if one gets Nav after 2 days, stil, two funds created more wealth. If you look at icici pru discovery fund, 3.54% of the times the Nav of the fund Fell by more than 2%, and whenever that happy, 48.70% of the times, the next day nav was further lower, it was beNeficial to Get The future nav and not only-day nav.

Eventually, by getting after-2-days Nav, the person was able to generate 0.70% more wealth compared to sleep-day Nav.

Conclusion and what we can learn

By the time you may have finalized out that whose time Nav can lead go up, they forget that the next nav can go down also and they can get an evern cheaper Nav.

Over time, if you are a regular investor who is there for the long term, sometimes you may get a little higher nav the next day and sometimes you may get a lower nav, which is evilly cancels out the idi. So here are the characters

- If you get next day nav, there is almost a 50% probability that you will get an even lower Nav

- Over a long time, the Amount of wealth you will make will not be very different in the case of sweet or next-day Nav

- The worry and frustration is not worth it at all, and you shall just not worry about what nav you are gettingting.

- If Markets Jump by 2-3% on a Given Day and You Want to Book Profits, then it’s better to sell the next day as the chance of getting

- While you may lose out a bit on a single transaction, there will be other transactions when you will benefit and in totality, you won’t lose out at all. In Fact, The Study Shows that you are better off getting the next day Nav to improve your returns, but then it’s a small margin.

- Next time when markets are down by a good Amount, Investing on that day is more important than which which will day nav you are gettingting. So Focus on Systematic Investment More Than Anything Else

Note that we are not discusing in this article if it’s morally right or wrong for amc to give you the next day Nav. Thos are surely technological challenges that need to be solved. In this article, we just wanted to do number crunching to find out which path is better and i hope we did the job

We would love to listen to your comments on this topic and if you think otherwise?