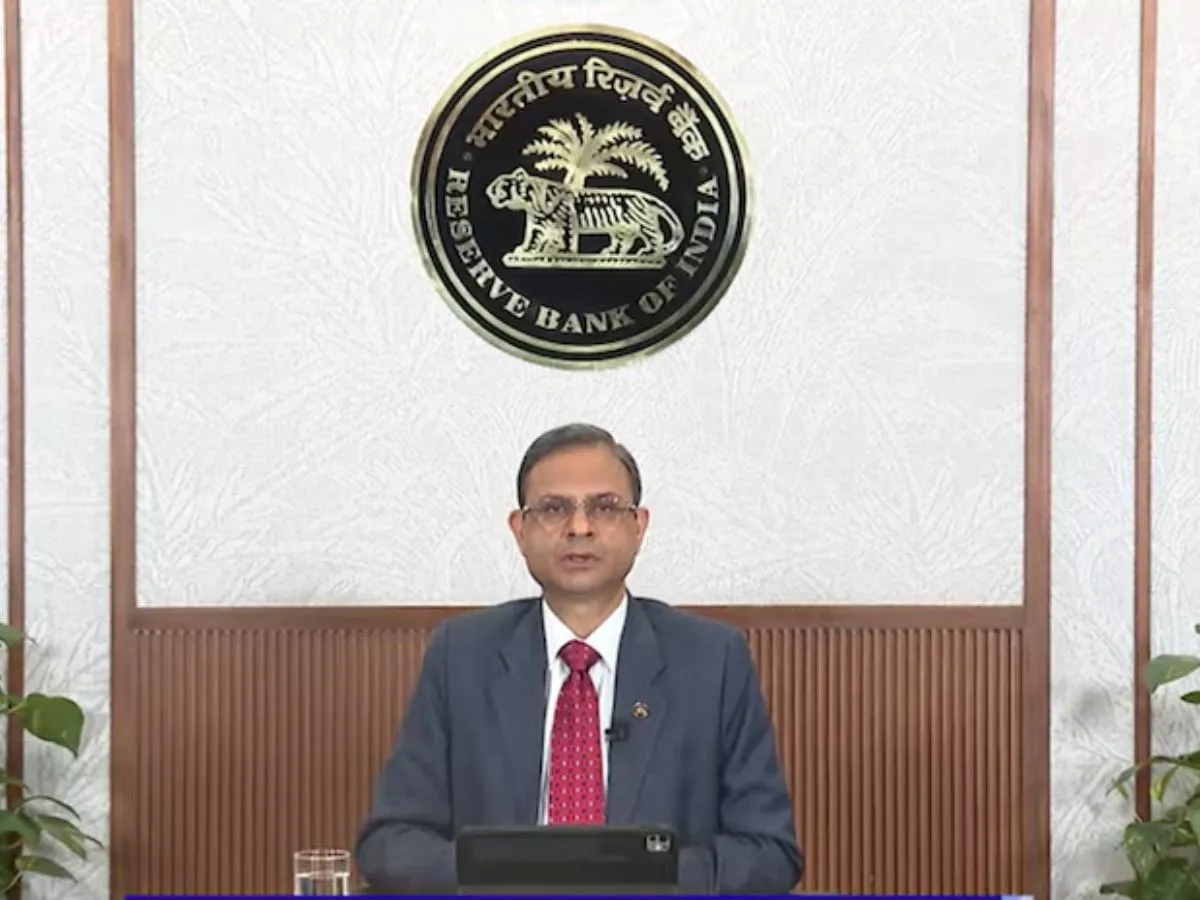

10 Best Debt Mutual Funds for 2025 as RBI Slasshes repo rate

Interest rates have a direct impact on debt mutual funds. In 2025, The Reserve Bank of India (RBI) has alredy reduced the repo rate by 25 Basis points in April, and another cut is expected in June and lateer-on Too. These rate cuts create a favorite environment for certain debt mutual funds, especially that sensitive … Read more