Given that the actual interest rate is 200 basis points, do you think there was scope for deduction of 50 basis points and the actual rate should be 5.25 percent as inflation is expected to be less than 4 %? The Reserve Bank has said that liquidity should be 1 to 1.5 percent of NDTL. Does the Reserve Bank want a comfortable limit for liquidity?

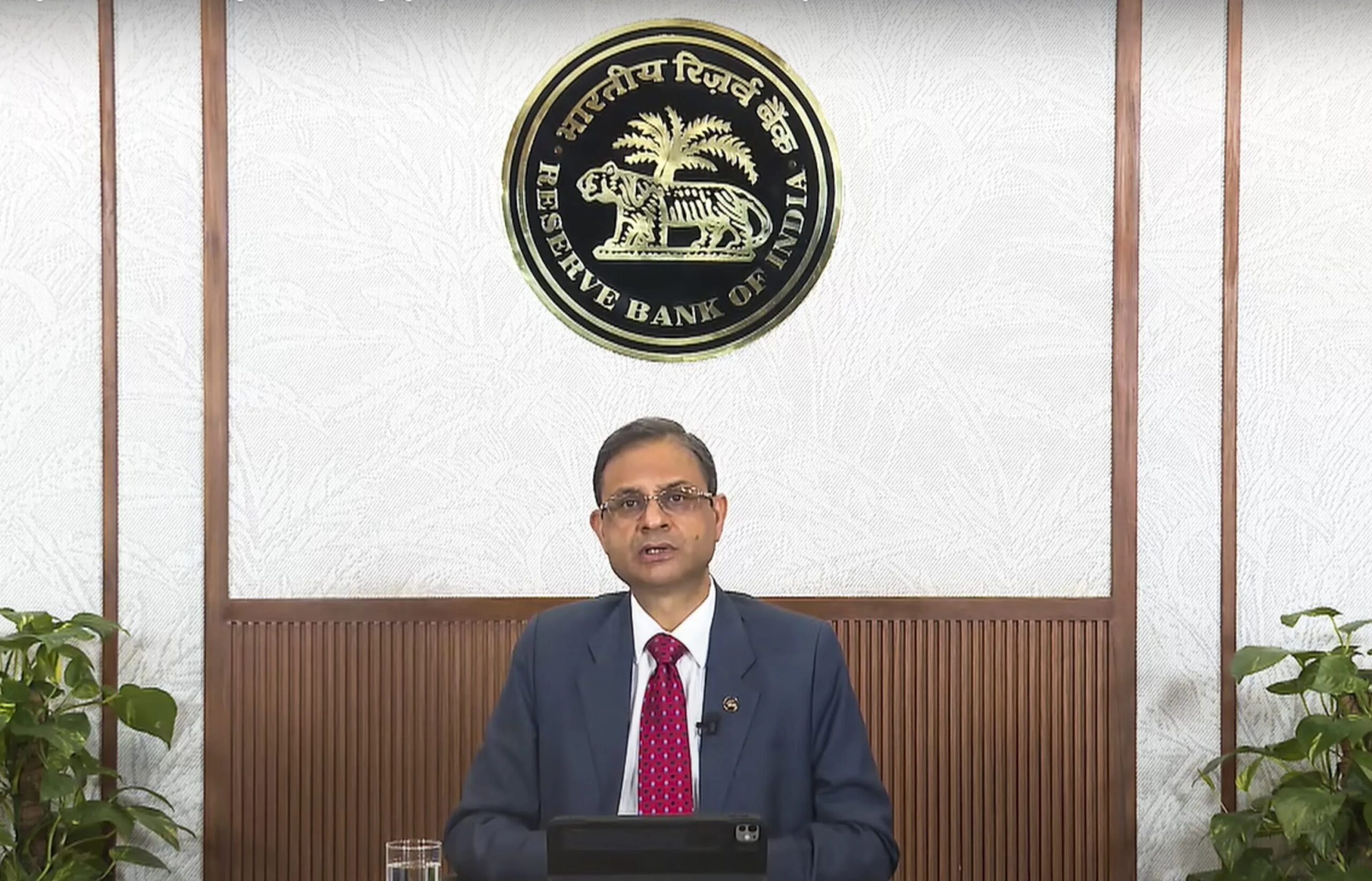

Sanjay Malhotra: I do not remember 1.5 percent. According to various studies, the actual rate should be around 1 to 1.9 percent. Therefore 1.5 percent is quite possible. As far as policy rates are concerned, later we have changed the stance from neutral to friendly. The average of inflation is 4 percent. We really do not know anything about next year. It is definitely less than 4 percent for the calendar year, but the next quarter, it is more than 4 percent in the first quarter. I have already mentioned in the statement about liquidity that we will keep it in surplus enough. I would again say that we will provide enough liquidity to bring the effect of monetary policy.

Will you tell about 1 percent NDTL target? You said that maintaining 1 percent cash surplus in the system is the target which is about 2.7 lakh crore rupees.

Malhotra: I will not keep it limited to one percent but it is a kind of scope. Is around the realm. If more needed, we will do more. If less required, we will reduce. As I said the main objective is to ensure proper communication of regulatory means.

You said that you cannot say what is going to happen next in case of rates. But, what will happen if the major central banks continue it for a long time? You have changed the stance, but is there scope for further rate cuts?

Malhotra: I said in my statement that the impact of global fees and uncertainties on India is considered. But we believe that domestic inflation and growth will mainly decide our stance and policy decisions. While we will be vigilant towards global developments, they will have a limited impact on India.

Has the Reserve Bank changed its stance on the coaling system?

Malhotra: I believe that the co-losing system has helped to give loans to the primary sector. We are now expanding it in other areas other than PSL. Currently, only banks and non-banking financial companies can join this system. Now two banks can also join it. Under this, the borrower gets the benefit of a low interest rate as banks get the amount at a low rate and the non-banking financial companies compensate for what they do not have.

Swaminathan Jah: We are increasing the number of participants by increasing it to all the regulations and we are also trying to increase coverage other than PSL.

First Published – April 9, 2025 | 11:47 pm IST

Related post

(Tagstotranslate) RBI Real Interest Rate (T) Sanjay Malhotra RBI (T) REPO RATE CUT SCOPE (T) Liquidity Surplus RBI (T) NDTL LIQUIDITY RATIO (T) Monetary POLICY StANDING Model India (T) Bank-NBFC co-lending